- USD/CHF stuck between 0.8180–0.8300 as buyers fail to sustain breakout above resistance.

- RSI remains bearish; a break below 0.8200 could expose the May 7 low and YTD trough at 0.8034.

- Bulls must reclaim 0.8250 to retest 0.8300 and challenge the 50-day SMA at 0.8376.

USD/CHF trades subdued on Friday after a US report showed that inflation is approaching the Federal Reserve’s (Fed) 2% goal. Meanwhile, US President Trump complained about the slow negotiations between Beijing and Washington, which have roiled the markets. However, he stated that he would speak with China’s President Xi Jinping to help resolve the issue. The pair is trading flat at 0.8227.

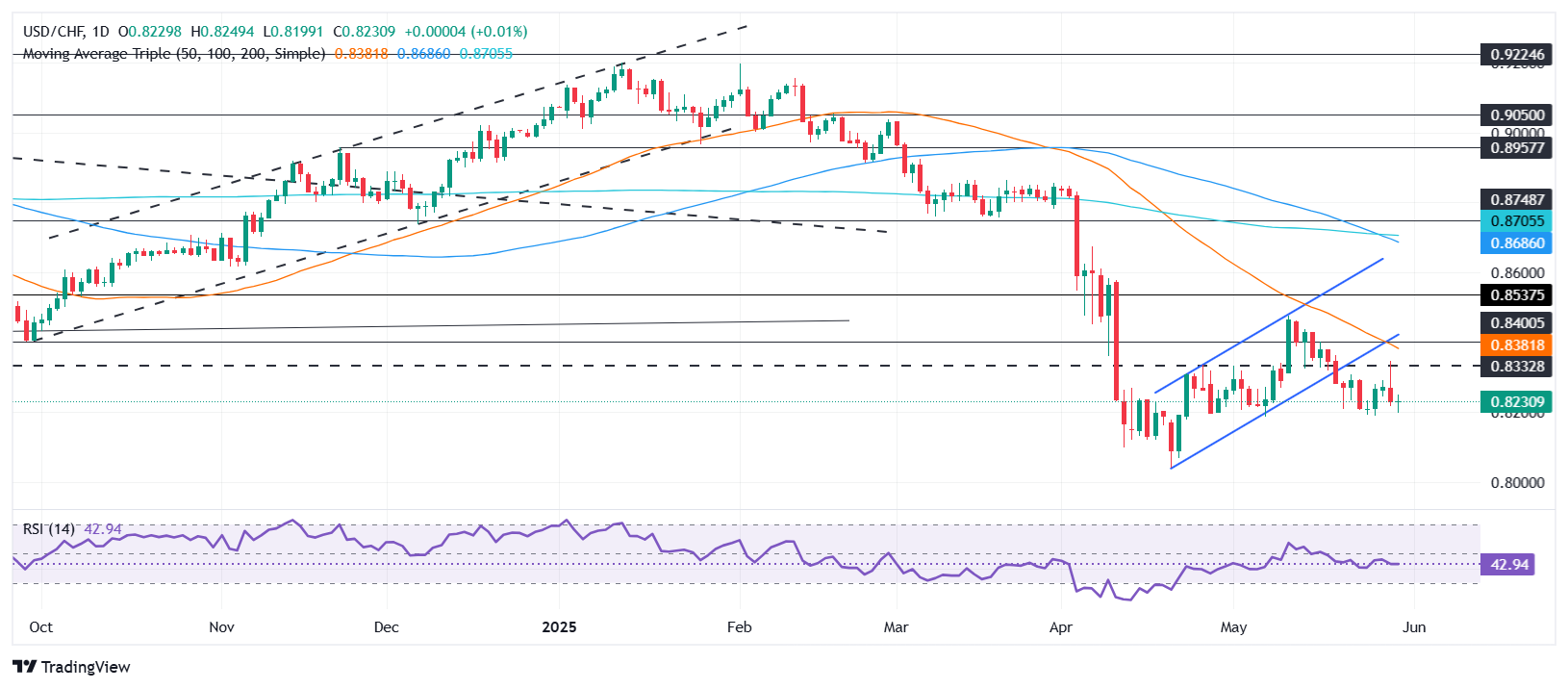

USD/CHF Price Forecast: Technical outlook

USD/CHF remains downward biased, but the trend stalled, consolidating within the 0.8180-0.8300 range during the last eight days. On Thursday, the pair reached a seven-day high of 0.8347, but buyers failed to hold onto the 0.8300 mark, which exacerbated the pair’s decline toward the 0.8200 mark.

Momentum, as measured by the Relative Strength Index (RSI), is bearish, but buyers holding USD/CHF above 0.8200 could open the door for higher prices.

Despite this, the path of least resistance is downwards. The first support is 0.8200, followed by the May 7 low of 0.8184. On further weakness, the next support seen is 0.8034, the year-to-date (YTD) low.

Conversely, if USD/CHF rallies past 0.8250, look for a test of 0.8300. On further strength, the next resistance would be the 50-day Simple Moving Average (SMA) of 0.8376, followed by the 0.84 mark.

USD/CHF Price Chart – Daily

Swiss Franc FAQs

The Swiss Franc (CHF) is Switzerland’s official currency. It is among the top ten most traded currencies globally, reaching volumes that well exceed the size of the Swiss economy. Its value is determined by the broad market sentiment, the country’s economic health or action taken by the Swiss National Bank (SNB), among other factors. Between 2011 and 2015, the Swiss Franc was pegged to the Euro (EUR). The peg was abruptly removed, resulting in a more than 20% increase in the Franc’s value, causing a turmoil in markets. Even though the peg isn’t in force anymore, CHF fortunes tend to be highly correlated with the Euro ones due to the high dependency of the Swiss economy on the neighboring Eurozone.

The Swiss Franc (CHF) is considered a safe-haven asset, or a currency that investors tend to buy in times of market stress. This is due to the perceived status of Switzerland in the world: a stable economy, a strong export sector, big central bank reserves or a longstanding political stance towards neutrality in global conflicts make the country’s currency a good choice for investors fleeing from risks. Turbulent times are likely to strengthen CHF value against other currencies that are seen as more risky to invest in.

The Swiss National Bank (SNB) meets four times a year – once every quarter, less than other major central banks – to decide on monetary policy. The bank aims for an annual inflation rate of less than 2%. When inflation is above target or forecasted to be above target in the foreseeable future, the bank will attempt to tame price growth by raising its policy rate. Higher interest rates are generally positive for the Swiss Franc (CHF) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken CHF.

Macroeconomic data releases in Switzerland are key to assessing the state of the economy and can impact the Swiss Franc’s (CHF) valuation. The Swiss economy is broadly stable, but any sudden change in economic growth, inflation, current account or the central bank’s currency reserves have the potential to trigger moves in CHF. Generally, high economic growth, low unemployment and high confidence are good for CHF. Conversely, if economic data points to weakening momentum, CHF is likely to depreciate.

As a small and open economy, Switzerland is heavily dependent on the health of the neighboring Eurozone economies. The broader European Union is Switzerland’s main economic partner and a key political ally, so macroeconomic and monetary policy stability in the Eurozone is essential for Switzerland and, thus, for the Swiss Franc (CHF). With such dependency, some models suggest that the correlation between the fortunes of the Euro (EUR) and the CHF is more than 90%, or close to perfect.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Editors’ Picks

EUR/USD looks weak in the low-1.1300s

Following the release of the headline US PCE in April, which came in below forecasts, EUR/USD continues to be on the defensive and navigates the low-1.1300s on the back of a decent rebound in the US Dollar. Spot, in the meantime, is expected to enter a cautious mode pre-ECB meeting in the next week.

GBP/USD comes under pressure, back near 1.3470

The selling momentum now gathers pace around the British Pound, sending GBP/USD to the area of 1.3480-1.3470 at the end of the week. This occurs in the midst of an acceptable bounce in the Greenback, as investors continue to evaluate the lower-than-expected US PCE readings.

Gold keeps its offerd bias unchanged around $3,300

Gold remains on the defensive around the $3,300 mark per troy ounce in the wake of weaker-than-estimated US inflation data for April. In the meantime, trade uncertainty and lower US yields seem to limit the metal’s downside.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you’re a beginner or an expert, find the right partner to navigate the dynamic Forex market.