By Tim Peterson • April 23, 2025 •

Ivy Liu

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at a report from Innovid that seems to show CTV advertisers’ reach and frequency calibrations are out of whack.

- Beyond reach

- Productions’ Hollywood exodus, Netflix’s podcast interest and more

Beyond reach

For all the increasing attention being paid to business outcome measurement, reach and frequency remain the main metrics for ads running across connected TV platforms and streaming services. So as this year’s upfront negotiations near, it’s worth asking: To what extent are advertisers reaching audiences on CTV and how often?

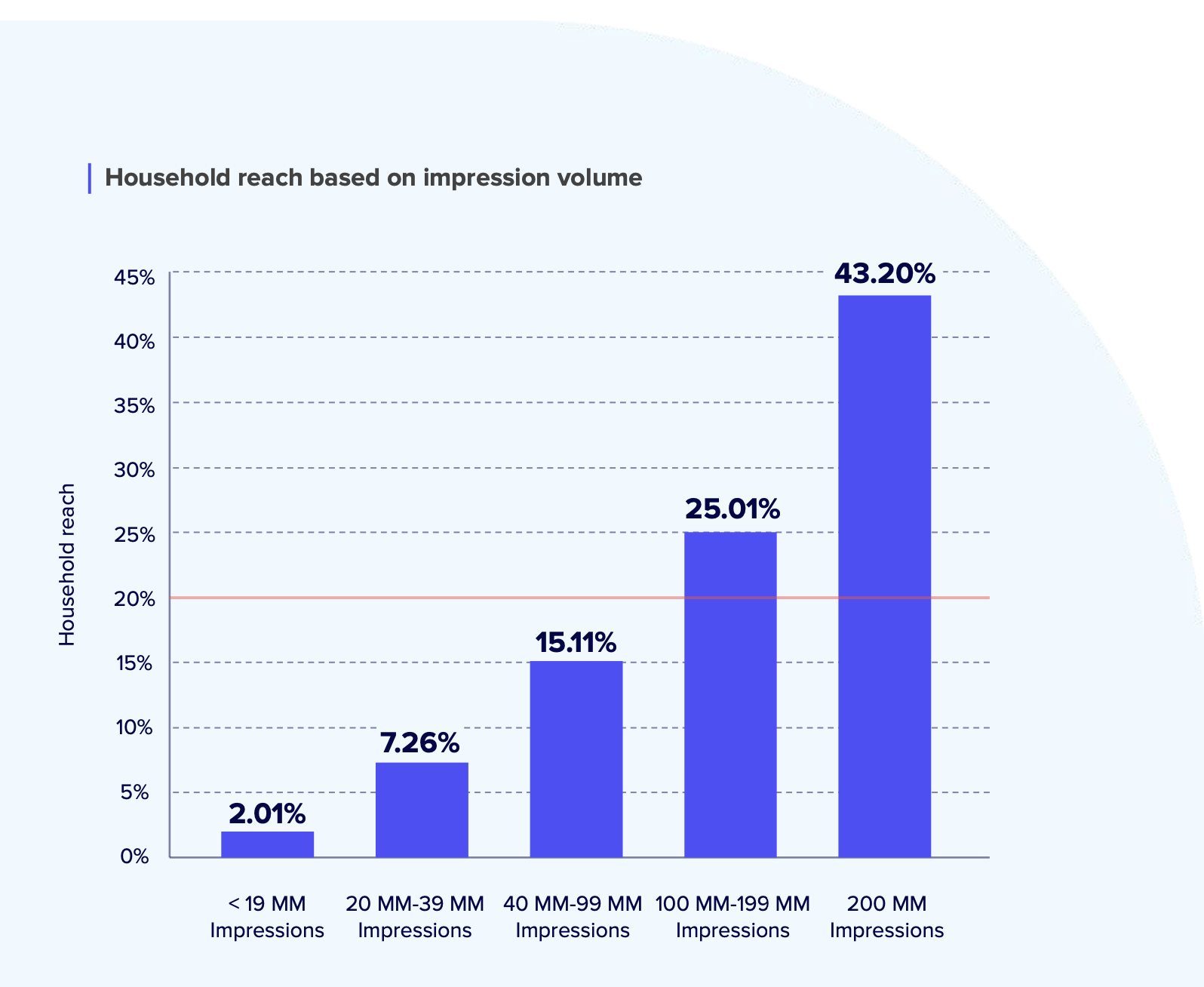

Welp, when it comes to reach, the answer is not enough. In 2024, the average CTV ad campaign running through Innovid’s ad tech platform – which spans 95 million U.S. households – only reached 19.6% of those households, according to Innovid’s latest “CTV Advertising Insights Report,” which is being published on today.

In other words, the average CTV ad campaign last year failed to reach four-fifths of the total addressable audience. Now, to what extent can advertisers even conceivably hope to reach every CTV household in the age of audience fragmentation is a valid question, as is the consideration of how costly and cost-effective it would be to do so. But still. That the average CTV ad campaign reached shy of 20% of households “is low,” said Innovid CEO and co-founder Zvika Netter in an interview.

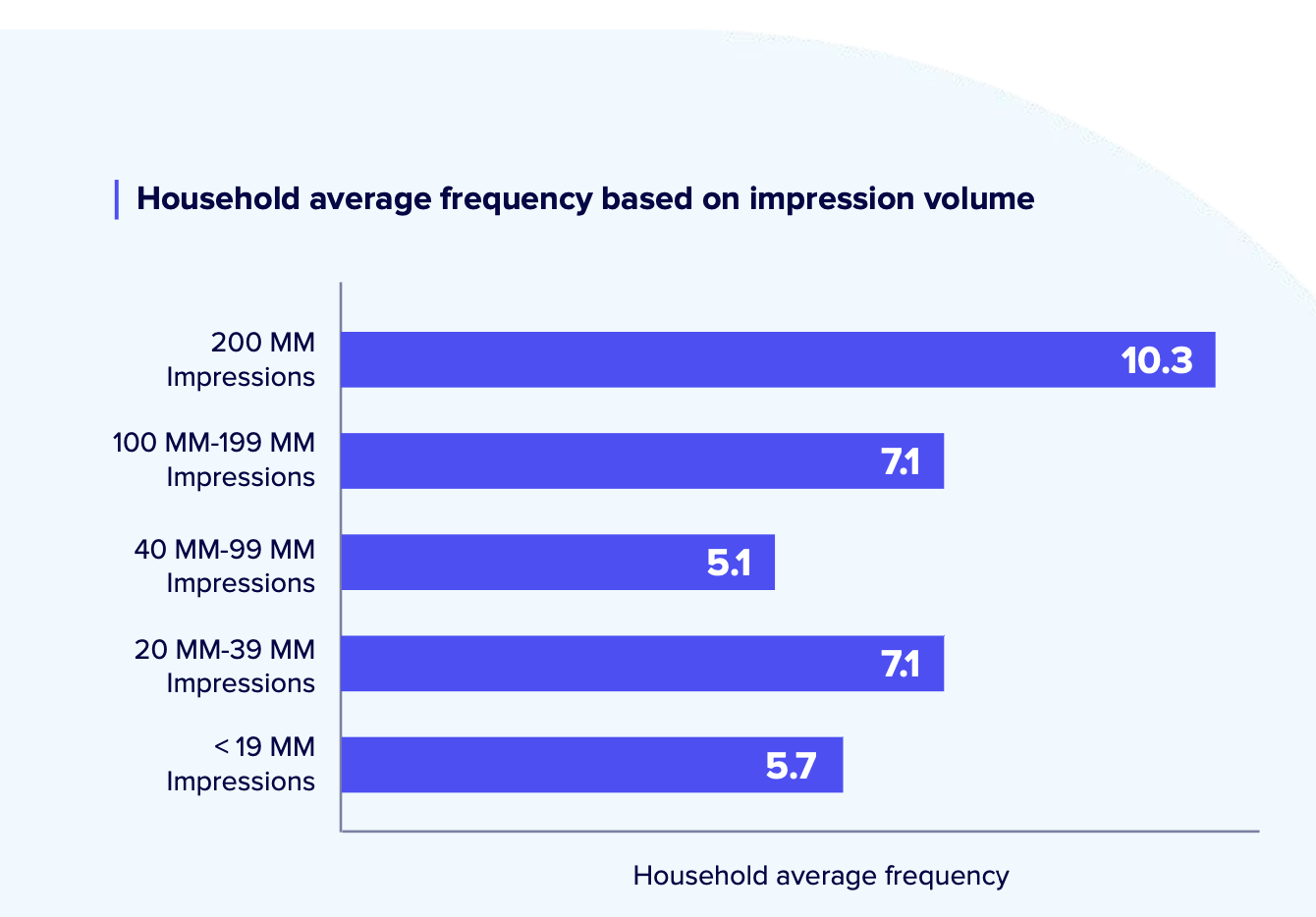

Speaking of low, the number of times that the average household saw a given CTV ad has lowered, if only very slightly. In 2024, the average CTV household was served a given campaign 7.09 times, which is a dip from 7.42 exposures in 2023.

That CTV ad frequency stasis would seem to be a positive sign. According to agency executives, the typical frequency caps for streaming campaigns range from 7 to 10 exposures per household per week. However, there’s a reason that brand and agency executives tend to always say “reach” and “frequency” in the same breath. The two are intertwined.

“It’s really about maximizing reach against the right audiences and trying to mitigate as much excessive frequency as possible,” said one agency executive.

“That’s a huge sticking point within everyone’s CTV strategy: How do we really maximize on the users we’re hitting without over-spamming?” said a second agency executive.

Based on Innovid’s report, CTV ad buyers seem to be doing a fine job of not over-spamming, but there’s work to be done when it comes to maximizing reach. As the agency executives indicated, though, the real trick is to balance the two. And Innovid’s report seems to show that the balance between reach and frequency for CTV campaigns is out of whack – unless an advertiser is really overloading on impressions.

OK, admittedly, this idea that the more ads that are served, the more audiences that are reached, the more times those audiences are reached – that’s kinda laughably obvious. What’s actually eye-opening is the Goldilocks problem. Advertisers that aren’t going full spray and pray with 200+ million-impression campaigns are seeing a disproportionate drop-off in reach compared to frequency.

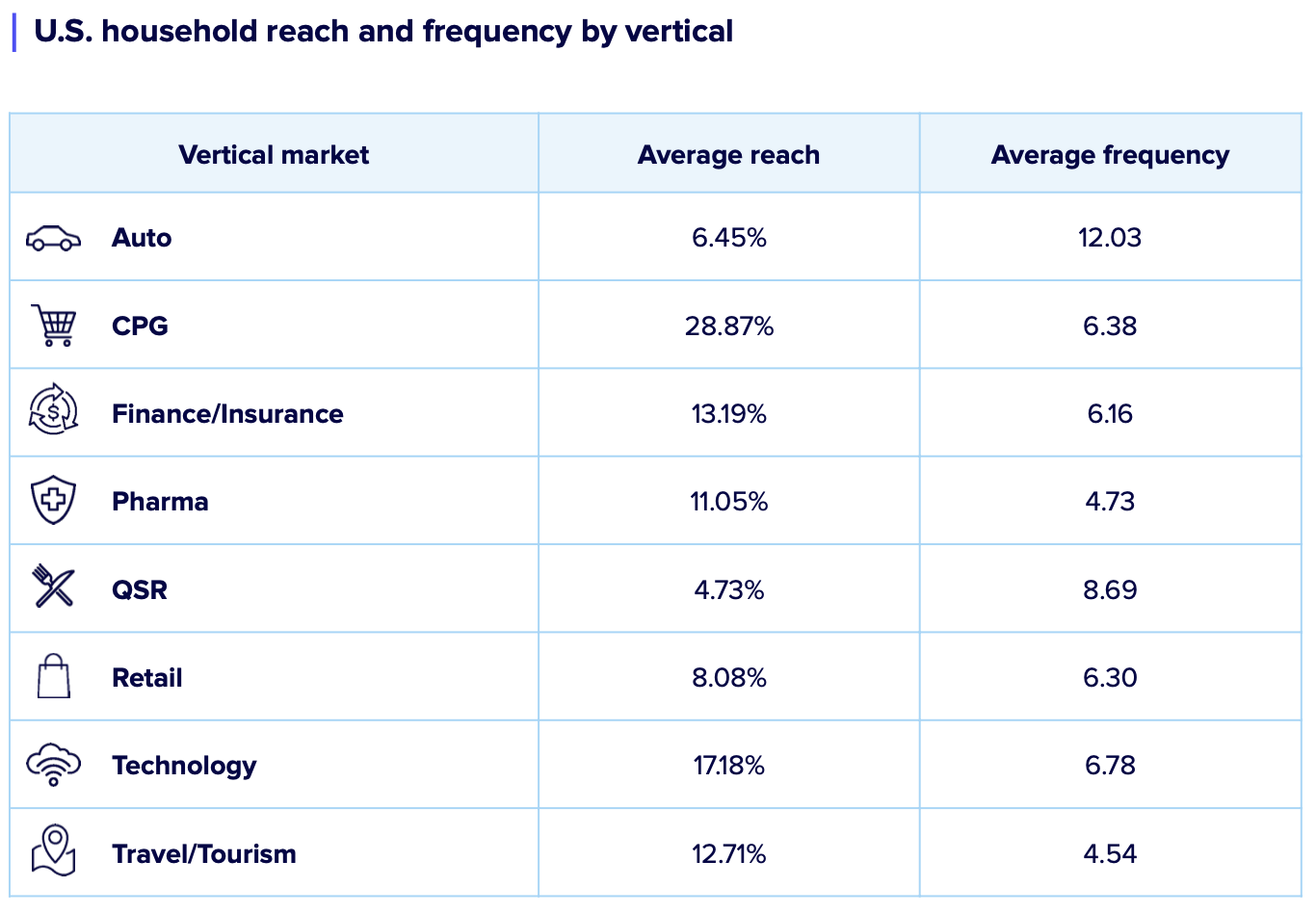

Now, this may be intentional. Consider how auto advertisers may prefer to reach a more targeted audience and advertise to them more often because the car-buying process is a long cycle that can take some convincing. By contrast, a consumer packaged-goods brand may rather reach as many people as possible as few times as necessary to cost-effectively get them to pick up their cereal product the next time that someone’s doing their food shopping. And here’s a chart from Innovid’s report showing that maybe – maybe – what’s happening, with auto advertisers recording the highest frequency and CPG advertisers notching the highest reach.

But then look at the category of quick-service restaurant advertisers. Their CTV ads received the lowest reach but at the second-highest frequency. Is the audience for burgers and burrito bowls really so narrow and in need of a relatively long sales cycle? Probably not.

Even the auto advertiser stats may not actually be such a shining example. Consider how common car ads are during live sports broadcasts, which offer the broadest reach of all programming categories. Through that lens, auto advertisers’ CTV campaigns recording the highest frequency but second-lowest reach among all advertiser categories may actually be even more indication than QSR advertisers that advertisers need to recalibrate their reach-and-frequency recipes.

“If your target’s too narrow, there’s only so many households that fit your target, so of course you’re going to over-frequency that household,” said a third agency executive.

What we’ve heard

“Advertisers are so nitpick-y about brand safety on the open web, but in CTV, they don’t know what shows they’re delivering against.”

— Agency executive

Numbers to know

$10.5 billion: How much total revenue Netflix generated in the first quarter of 2025.

59%: Percentage share of surveyed consumers who said they have connected TV device and smart TV that is powered by Roku’s operating system.

~700: Number of channels that Samsung’s free, ad-supported streaming TV service is bloated with boasts.

28.07: Number of hours per week that the average person worldwide spent watching TV — including streaming and digital video — in 2024.

What we’ve covered

As ‘recessionposting’ enters overdrive, creators are taking steps to dodge potential blowback:

- Some creators are wary of making videos related to the potential recession.

- Others are looking to ensure they properly source any financial information they share.

Read more creators here.

How the current chaos affects influencer marketing:

- Some influencer marketing agencies have yet to see a tariff-related impact on marketers’ influencer spending.

- Others, however, have started to see some pullbacks.

Read more about influencer marketing here.

In the CTV race, LG Ad Solutions starts at the home screen:

- LG is following the playbook set by Roku, Samsung and others to have its CTV platform be a gateway for advertisers.

- Much of its ad sales attention seems oriented around the CTV platform’s home screen.

Read more about LG’s CTV ad sales here.

How Hyundai’s CMO is navigating upfront marketplace uncertainty and rapid-response tariff ads:

- The auto brand plans to “be strong in the market” for this year’s upfront negotiations, per its marketing boss.

- Hyundai is a halftime sponsor of ESPN’s and ABC’s NBA playoffs coverage.

Read more about Hyundai here.

What we’re reading

Productions’ Hollywood exodus:

Film and TV productions have been flocking away from LA to shoot internationally in order to avoid Hollywood’s higher production costs, according to The New York Times.

Netflix’s podcast interest:

The streaming service’s co-CEO used Netflix’s latest earnings call to throw open the door to video podcasters pitching to be on its platform, according to The Hollywood Reporter.

Amazon’s new CTV platform:

The Fire TV maker plans to debut a new CTV device powered by a new CTV operating system called Vega that would seem to draw more of a technical connection to Amazon’s connected home device lineup, according to Lowpass.

https://digiday.com/?p=576181